Economic Policy through the Lens of History

by Roger E. A. Farmer

The ideas of economists and political philosophers, both when they are right and when they are wrong, are more powerful than is commonly understood. Indeed the world is ruled by little else. Practical men, who believe themselves to be quite exempt from any intellectual influence, are usually the slaves of some defunct economist. Madmen in authority, who hear voices in the air, are distilling their frenzy from some academic scribbler of a few years back.

—John Maynard Keynes

Ideas are powerful. They dictate the way we behave. When ideas are acted upon by powerful people they affect all of our lives.

Ideas are powerful. They dictate the way we behave. When ideas are acted upon by powerful people they affect all of our lives.

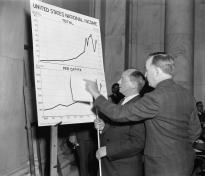

In 2008 the world experienced a financial crisis. In the space of a month, the stock market lost 40 percent of its value and the world entered the worst recession since the 1930s. The US unemployment rate went from 4.5 percent to 10 percent. Between September 2008 and September 2009 the economy lost half a million jobs a month.

Following the 2008 crisis, there was a fierce debate in the press between classical economists like Eugene Fama of the University of Chicago and Robert Barro of Harvard, and Keynesian economists like Paul Krugman of Princeton University and Brad Delong of the University of California at Berkeley. Classical and Keynesian ideas have been actively debated by economists for seventy years. When one side or the other gains more credibility, the effect on all of our lives is substantial.

Policy makers are guided by economic theories. In the 1990s and early 2000s classical economists argued that markets should be given free rein. Their ideas led to deregulation of the financial markets in the late 1990s and the repeal of legislation that had been put in place during the Great Depression. Classical ideas ascended for thirty years, beginning in the 1970s and ending with the onset of the financial crisis in 2008.

In response to the 2008 crisis, the pendulum of economic ideas has swung back towards regulation. Policy makers in the Obama administration are influenced by the ideas of the English economist John Maynard Keynes. Keynes argued that free markets need to be controlled and that government should be held responsible for ensuring that everyone who wants a job has one.

Why is there such disagreement amongst economists, politicians, and journalists about economics? Who are the classical and Keynesian economists and what did they say? Most importantly, how has economic history influenced the development of classical and Keynesian ideas?

Classical and Keynesian Economics

The economic history of the past hundred years can be divided into three periods, each guided by one of two different economic theories: classical and Keynesian economics.

Before 1930, classical economics was dominant. In the period from 1946 to 1976 classical ideas were replaced by a new theory, Keynesian economics. From 1976 through to 2008 classical economics once more gained the upper hand.

The swing from classical to Keynesian economics (1946 to 1976) and back again to classical ideas (1976 to 2008) was driven by historical events. The rise of capitalist free-market economies in the mid-eighteenth century led to dramatically improved living standards and Scottish economist Adam Smith developed classical economics to explain their remarkable success.

During the Great Depression of the 1930s capitalism failed in a spectacular way as the unemployment rate in the United States climbed to 24 percent. This failure of free markets to deliver prosperity led to a rejection of classical economic theory and the development of an alternative set of ideas to explain what had gone wrong: Keynesian economics.

From the end of World War II through the mid-1970s, most economists were Keynesians. But during the 1970s, Keynesian economics itself came under attack when it failed to explain how high inflation and unemployment could coincide as they did at the end of that decade. Economists retreated to classical ideas, which they reformulated using mathematics. By that time, the Great Depression had been forgotten and faith in free markets was once again the dominant view.

All that changed in 2008 when a financial crisis of epic proportions reminded us that market economies could sometimes go spectacularly wrong. The 2008 recession caused economic theorists once again to rethink their positions. Now, we are likely to enter a new era that draws on ideas from both schools of thought.

The Birth of Classical Economics

Capitalism began in sixteenth-century Europe. It was made possible by a new legal institution, the joint stock company, which allowed many people to pool their resources in large-scale ventures while limiting their liability if the venture failed. The first joint stock company in England was the Muscovy Company, created by royal charter in 1555, although it wasn’t until the eighteenth century that capitalism really began to flourish.

Capitalism was accompanied by the rise of political and economic liberalism. Political liberalism is the idea that every adult human being has the right to express his or her opinions freely. Economic liberalism is the idea that the free exchange of goods in markets makes everybody better off.

By the American Revolution in 1776, liberal ideas were in the ascendancy. Political liberalism gave birth to democracy, fostered by the then-radical notion that rulers govern with the consent of the people. Economic liberalism led to our modern system of production whereby individuals are free to buy and sell goods in markets in pursuit of profit.

In 1776, the Scottish philosopher Adam Smith penned An Inquiry into the Nature and Causes of the Wealth of Nations and the science of economics was born. Smith wrote:

It is not from the benevolence of the butcher, the brewer, or the baker, that we expect our dinner, but from their regard to their own self-interest. We address ourselves, not to their humanity but to their self-love, and never talk to them of our own necessities but of their advantages.

Or as Gordon Gekko, the fictional character in Oliver Stone’s 1987 movie Wall Street put it; "Greed is good." What is the evidence for this remarkable claim?

Capitalism and Growth

Before the advent of capitalism, there was very little improvement in living standards. The lifestyle of the average person in Roman times, two thousand years ago, was not very different from that of a peasant in fifteenth-century England.[1] Although the rulers of Rome lived in relative luxury, as did the kings of England, even the poorest person in an advanced society today enjoys many luxuries that would have been inconceivable to Julius Caesar or Henry VIII.

Since the inception of capitalism in sixteenth-century Europe, income per person has grown at a bit less than 2 percent per year, and as a consequence, the standard of living of the average person has doubled every thirty-five years.[2] The power of compound growth is staggering. By fostering this growth, capitalism has been responsible for pulling more human beings on this planet out of misery than any other known form of social organization.

Yet capitalism is not a monolithic concept. Free exchange cannot happen without a legal system that clearly defines how contracts will be enforced. Ever since the inception of capitalism, a fierce debate has raged between those who favor more or less regulation of free markets.

On the one hand, classical economists believe that more often than not, unregulated markets work well. On the other, Keynesian economists believe that it is the responsibility of the government to intervene in markets to make sure all are employed.

Capitalism and Crises

Although capitalism delivers growth, it does not deliver steady growth. Sometimes growth sputters, and when it does, many people lose their jobs at the same time. When growth falls temporarily, we say that the economy is in recession. There have been ten recessions since World War II and most of them have been relatively mild. But sometimes recessions can be very deep. When this happens, many people begin to question the ability of capitalism to deliver prosperity.

Capitalism developed in a symbiotic relationship with democratic political institutions. When a crisis occurs, democracies evolve new institutions to help combat the crisis. A good example of this is the development of central banks like the Bank of England in the United Kingdom or the Federal Reserve System in the United States. Central banks were created to cope with a series of financial panics, very similar to the current crisis, that occurred during the nineteenth century. In the United States, deep recessions were accompanied by bank failures in 1819, 1837, 1857, 1873, and 1893.

As we saw in 2008, when a nation’s financial system fails, it pulls the whole economy down. To help prevent the disastrous effects of financial crises, the English economist Walter Bagehot (pronounced "Ba-jet") wrote a book in 1873 called Lombard Street in which he outlined the principles of effective central banking. Bagehot was an early editor of the Economist and the son-in-law of its founder, James Wilson. Lombard Street was London’s financial center and the nineteenth-century equivalent of Wall Street today. Partly as a result of his seminal ideas, the Federal Reserve System, America’s central bank, was created in 1913.

The Great Depression

The 1920s was a period of remarkable prosperity in the United States, much like the 1990s and early 2000s. President Calvin Coolidge fiercely defended free markets. During his presidency, from 1923 to 1929, the stock market climbed to remarkable heights and free-market ideas were on the rise.

All of this suddenly came to an end when the stock market fell by 24 percent in two days in October 1929. By 1933, the market had lost 84 percent of its value. Shortly after the stock market crash, unemployment began to climb. By 1933, 24 percent of the labor force was without a job. The immense human misery of this period gave rise to a deep distrust of capitalism. As the American author John Steinbeck put it in his novel The Grapes of Wrath, "Men who have created new fruits in the world cannot create a system whereby their fruits may be eaten. And the failure hangs over the State like a great sorrow . . . and in the eyes of the people there is the failure; and in the eyes of the hungry there is a growing wrath. In the souls of the people the grapes of wrath are filling and growing heavy, growing heavy for the vintage."

In response to this failure of the free market, the English economist John Maynard Keynes wrote an important and influential book, The General Theory of Employment Interest and Money, published in 1936. This book changed the world. Before The General Theory, the idea that the government has a responsibility to provide jobs was almost unheard of. After the publication of The General Theory, it became widespread. In 1946, Congress passed the Employment Act, which gave government a new responsibility, the maintenance of full employment.

Two Visions of the World

Capitalist economies have been subject to repeated cycles of prosperity and depression ever since the seventeenth century. Classical economists developed theories of why these cycles occur. In 1928, the English economist Arthur Pigou wrote an important book on the topic called Industrial Fluctuations.

Pigou listed at least six different causes of business cycles: industrial disputes, agricultural shocks caused by bad weather, monetary disturbances, changes in tastes, invention of new technologies, and shocks to consumer and business confidence. The Norwegian economist Ragnar Frisch provided a physical model that further captures this classical vision, likening the economy to a rocking horse that is constantly hit by a child with a club. Blows from the club represent economic shocks. An airline pilots’ strike, an oil spill in the Gulf of Mexico, or the invention of the computer are significant blows. If the rocking horse were no longer hit with these blows it would quickly come to rest. Similarly, if the economy were no longer hit with shocks, the free market would quickly restore full employment.

As a direct result of his real life experience of the Depression, Keynes disagreed with the classical vision. Instead, he introduced what I consider to be his two most important new ideas. First, he argued that the labor market does not work well and that without a little help from government, very high unemployment can persist forever. Second, he argued that the rate of unemployment is determined by the beliefs of participants in the financial markets; he said that the beliefs of traders on Wall Street were governed by "animal spirits." In a famous passage in The General Theory, Keynes compared investors in the stock market to judges of a beauty contest who, instead of judging the beauty of the contestants, are trying to guess how beautiful the other judges think the contestants are.

Keynes’ theory linked the stock market with the labor market. In his view, the loss of confidence by investors caused the Great Depression. When businessmen and women lost confidence in the economy they stopped buying new machines and factories. The firms that produced factories and machines laid off workers. When workers lost their jobs they stopped spending and that reduction in purchasing power caused more layoffs in other industries.

Keynes’ vision of the economy was very different from Frisch’s characterization of classical economics as a rocking horse. In my book How the Economy Works, I develop a different metaphor to describe Keynes’ vision.[3] The economy is like a sailboat on the ocean with a broken rudder. Gusts of wind represent economic shocks. If the winds die down, a sailboat can become becalmed on the ocean. In the same way, if the economy was no longer blown by economic winds, the free market could leave it with unemployment of 5 percent, 10 percent, or 20 percent.

Stagflation and Other Terms Defined

From 1946 until the mid-1970s, the rise of Keynesian ideas directly influenced economic policy. The size of government increased from 10 percent of the economy in 1929 to 20 percent in 1945. Since government spending is more stable than private spending, this helped dampen business cycles, which were four times less volatile after World War II than before. By reducing the volatility of business cycles, government intervention in the economy prevented large increases in unemployment during recessions. The use of government spending and taxes to stabilize the business cycle is called fiscal policy.

After WWII, central banks throughout the world began to intervene actively to combat recessions. In every one of the ten post-war recessions, the Federal Reserve lowered the interest rate at the beginning of each recession to help stimulate private demand. The use of interest rate changes to control recessions is called monetary policy.

Fiscal and monetary policy worked well to keep unemployment low from 1946 through 1976. But at the same time, there was a steady increase in inflation. By 1975 it had reached 11 percent per year while the unemployment rate was at 8 percent, a very high number by post-war standards.

Inflation is a steady increase in the average price of goods. It was not a problem during the Great Depression and instead, contemporary economists were concerned about deflation, a situation of falling prices. Between 1929 and 1933 prices and wages fell by 25 percent. Keynes thought that inflation would only occur if the economy were operating at full employment. He built this idea into the new theory he wrote about in his 1936 book.

Yet the coincidence of inflation and unemployment does occur. We call this stagflation. Because stagflation cannot occur in Keynesian theory, academic economists gave up on Keynes and the pendulum of ideas swung back to classical thought from 1979 to 2009. A new of wave of classical economists refined Pigou’s ideas by developing a mathematical theory that made them more precise.

Economic Science and the 2008 Crisis

Economics is a science, but it is not an experimental science. We cannot disrupt the lives of millions of people to find out if one policy works better than another. Instead, we must wait for time to experiment for us. The Great Depression and the occurrence of stagflation were two experiments that helped economists refine their ideas. The 2008 financial crisis is a third.

The 2008 crisis has been disruptive to economic theory because it has reminded us that free markets can fail in a spectacular way. Once again, policy makers are looking to Keynesian remedies. But the ideas of Keynes’ General Theory are not enough to help us now because his ideas do not explain the stagflation we experienced in the 1970s. Instead, economists are developing new ideas that put together Keynesian and classical ideas.

In the past, we developed institutions to help markets function smoothly. The Federal Reserve System was created to deal with nineteenth-century financial crises. The use of active fiscal and monetary policy evolved from our experiences in the Great Depression. Stagflation in the 1970s also led to change as central bankers created a new policy, called inflation targeting, to help deal with inflation.

In each of the previous episodes of change, academic economists developed new theories to explain the failure of the old. Our democratic system has created new institutions and policies to implement the recommendations that have come from new theories. The 2008 crisis, like its predecessors, is likely to lead not just to the birth of new ideas, but also to new policies to guide our economy into the next century.

[1] Angus Maddison, The World Economy, 1–2001 AD, from Historical Statistics, http://www.ggdc.net/maddison/.

[2] Angus Maddison, The World Economy, 1–2001 AD, from Historical Statistics, http://www.ggdc.net/maddison/.

[3] Roger E. A. Farmer, How the Economy Works: Confidence, Crashes and Self-Fulfilling Prophecies (New York: Oxford University Press, 2010).

Roger E. A. Farmer is Distinguished Professor of Economics and Chair of the Department of Economics at the University of California, Los Angeles. He is the author of two books on the current global economic crisis. How the Economy Works: Confidence, Crashes and Self-Fulfilling Prophecies is written for the general reader and specialist alike, and Expectations, Employment and Prices (2010) is written for academics and practicing economists. Both books are published with Oxford University Press.